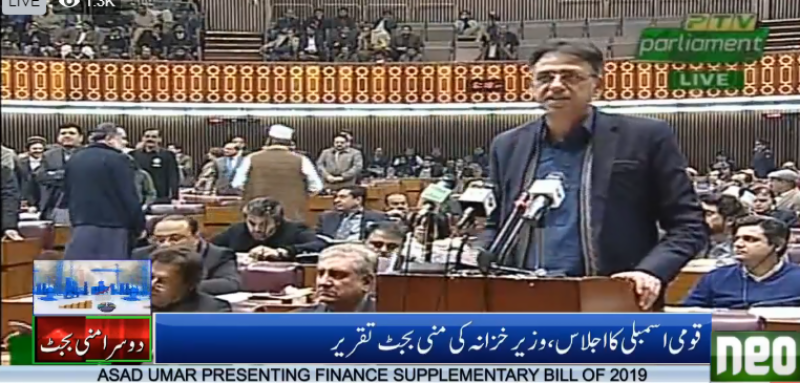

Islamabad (Staff Report/Agencies): Finance Minister Asad Umar is presenting Finance Supplementary (Second Amendment) Bill of 2019 — to generate more revenue for the government presented in the National Assembly.

The minister said that this was not a mini-budget being presented but rather a set of economic reforms.

The finance minister asked what the opposition had left behind for the people of Pakistan. “Two years ago an economic situation began to develop when all economic experts started to say that danger bells are ringing. But instead, those in power did not pay heed, they thought the people were ignorant, and instead they conspired to buy an election.”

Umar added that the deficit grew to Rs900 billion, asking who this gap would be filled. “Where will this gap be filled what? Will that come from their Swiss accounts? No. That money is filled with money paid by the citizens.”

He said there were record losses in Still Mills, Railways and the opposition had left the country in debt of up to Rs2,500 to Rs3,000 billion.

Salient features of Bill

Ban on purchase of vehicles for non-filers lifted for cars up till 1300CC capacity, but higher taxes will apply.

Withholding tax for filers on banking transactions will be eliminated.

Interest on agri loans reduced from 49pc to 29pc.

49 per cent tax on small and medium enterprises reduced to 20pc.

Introduction of interest free revolving credit of Rs5 billion (qarz-i-husna)

Small businesses exempted from submitting withholding tax returns every month; will do so only twice every year.

Rs20,000 fixed tax on marriage halls reduced to Rs5,000.

Pilot scheme to be introduced in Islamabad to facilitate traders in filing and paying taxes.

Duty on news print abolished completely.

Investment in solar panels and wind turbines to be exempt from duties and taxation for five years.

Reduction and abolishment (in some cases) of duties on raw materials to support export industries.

Super tax on non banking companies to be abolished.

Continuation of 1pc per annum reduction in corporate income tax.

Capital loss carry-over to be allowed for 3 years (stock trading).

Taxes on cars with engine capacity of 1800CC and above to be increased.

Taxes on mobile duties rationalised: taxes on budget sets to be reduced, high end sets to become more expensive.

Tax refunds to be worked out; promissory notes to be issued by mid February.

Gas Infrastructure Development Cess to be removed from fertiliser production.

Duty on diesel engines for agricultural applications to 5pc from current 17pc.