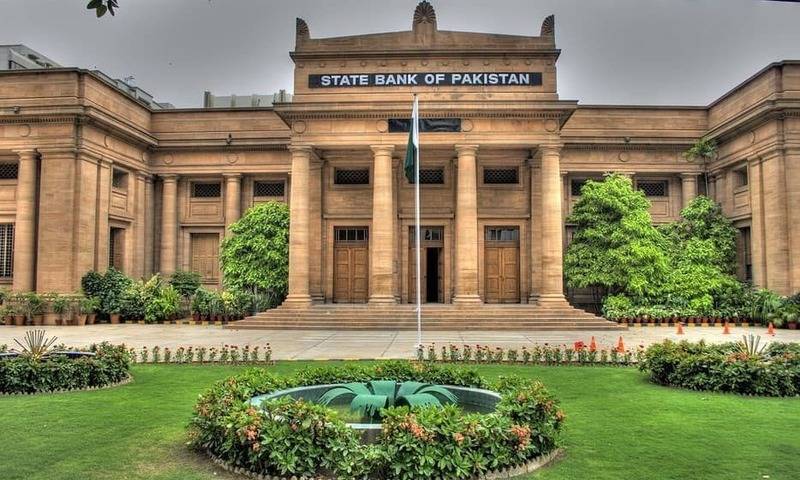

The Monetary Policy Committee (MPC) of State Bank of Pakistan (SBP) on Monday decided to hold the key policy rate at 22%.

A statement released after the MPC meeting said that the committee noted that headline inflation rose in September 2023 as expected. However, it is projected to decline in October and then maintain a downward trajectory, especially in the second half of the fiscal year".

931b8b4a7d1a97101328bcefc181d6c7While the recent volatility in global oil prices as well as the increase in gas tariffs from November 2023 pose some risks to the FY24 outlook for inflation and the current account, the monetary policy committee (MPC) also noted some offsetting factors.

"These include the targeted fiscal consolidation in Q1; improvement in market availability of key commodities; and the alignment of interbank and open market exchange rates."

The MPC noted the following key developments since its September meeting.

First, the initial estimates for kharif crops are encouraging and will have positive effects on other key sectors of the economy.

Second, the current account deficit narrowed considerably in August and September, which helped to stabilise SBP’s foreign reserves position amidst tepid external financing in these two months.

Third, fiscal consolidation remained on track, with both fiscal and primary balances improving during Q1-FY24.

Fourth, while core inflation remains sticky, inflation expectations of both consumers and businesses improved in the latest pulse surveys. "However, global oil prices remain quite volatile and the conflict in the Middle East makes its outlook even more uncertain."

It added that in light of these developments, the MPC emphasised continuing with the tight monetary policy stance.

The MPC reiterated its earlier view that the real policy rate is significantly positive on a 12-month forward-looking basis and is appropriate to bring inflation down to the medium-term target of 5-7% by end-FY25.

"However, the MPC noted that this outlook is based on continued fiscal consolidation and timely realization of planned external inflows, "the statement added.